A CEO’s non-technical guide to investing into Machine Learning and Data Science

CEOs are contending with a lot of technology buzz words. In this article I intend to convert the discussion about Data Science and Machine Learning into a business discussion. I will propose a few simple questions and make some assertions based on my experience with helping organizations big and small with these questions.

How do I separate hype from reality?

In addition to traditional technology acquisition finance models that focus on value delivery and cost of obsolescence, add greater emphasis to technology risk as a gating factor for approving investments.

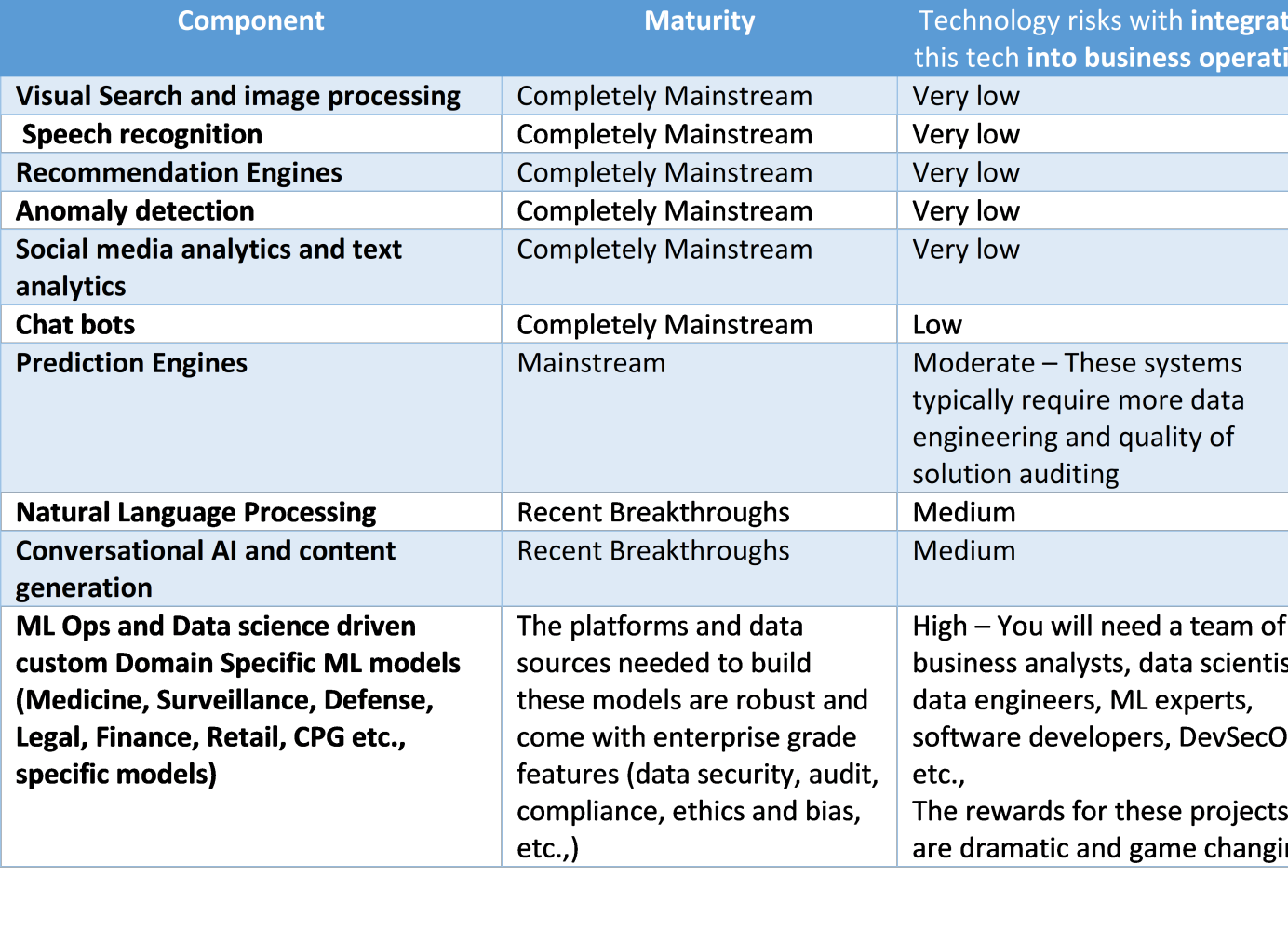

Here is a summary of technology risks with various AI/ML technology components.

Can your organization execute on these projects?

Skill gap, labor market tightness, lack of management bandwidth are endemic, how can a firm execute on new opportunities in this market?

Organizations are trying the following:

- Depending upon existing blue chip vendors to bring in this technology at their own pace.

- Creating a new office of Chief Innovation Officer/CTO/Chief Digital officer etc.,

- Investing heavily into HR to deal with skill gap and tight labor market.

I recommend adding the following additional strategies:

- Build and nurture relationships with small boutiques that take on 100% of the technology risk in these projects. Subscribe to and pay for successful solutions.

- Drive highly iterative culture into your technology acquisition projects.

- Significantly improve your firm’s ability to pull innovation from bottom up.

- Increase your ability to make equity investments into small tech firms that are trying to disrupt your markets.

Data driven intelligent automation has crossed a threshold of economic viability. Let the games begin!!